collected by :Jack Luxor

Companies around the world are building out battery capacity to fill the needs of automakers and energy storage developers alike. At the same time, Tesla's success in EVs and the growth of energy storage haven't gone unnoticed by competitors. That trend could change, but companies are investing in new battery capacity for projected demand for EVs and energy storage. But since then, lots of competitors have begun expanding battery capacity. For now, a combination of slower-than-hoped-for growth in EV demand and a boom in battery supply will leave the market oversupplied with batteries for the foreseeable future.

as informed in

Sealed Air (NYSE:SEE) and Cal-Maine Foods (NASDAQ:CALM) were a few of the individual stocks that attracted the greatest investor interest on Monday. Sealed Air still believes this is the right move for the company even if it will lower the company's sales base by almost 40%. Sealed Air plans to direct most of the $2.5 billion in net proceeds toward paying down debt that, as of the end of 2016, was $4 billion. Sealed Air's $3.2 billion dealSealed Air stock dropped 2.5% on heavy trading volume after the company announced a deal to raise cash by parting with a big chunk of its business. Today's stock marketIndex Percentage Change Point Change Dow (0.22%) (45.74) S&P 500 (0.10%) (2.39)Financial stocks trailed the broader market, which sent the popular Financial Select Sector SPDR ETF (NYSEMKT:XLF) down by 0.4%.

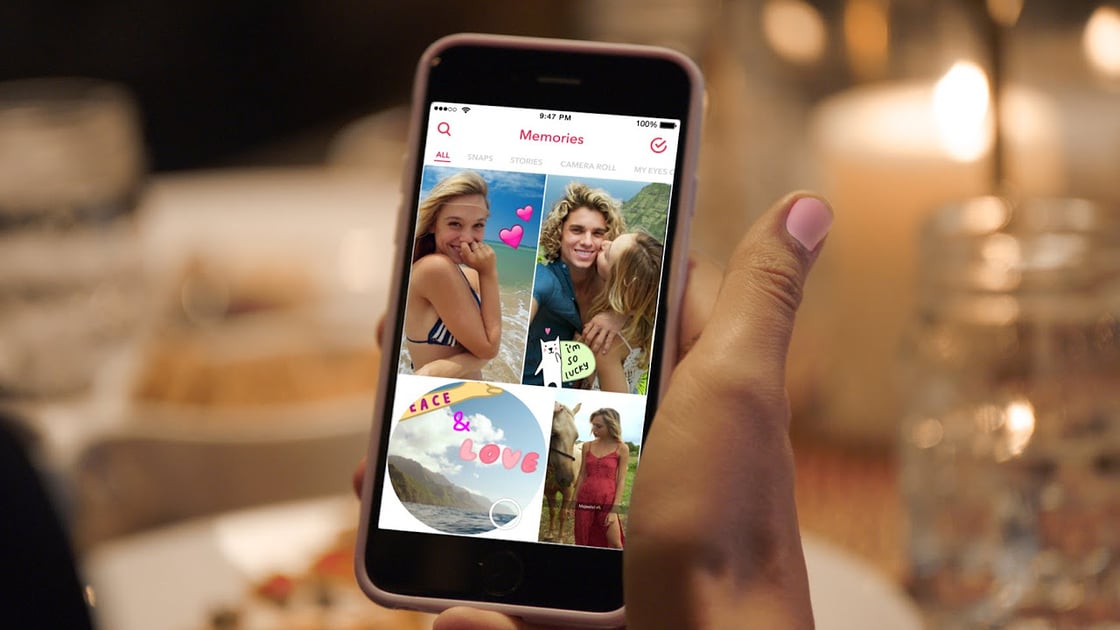

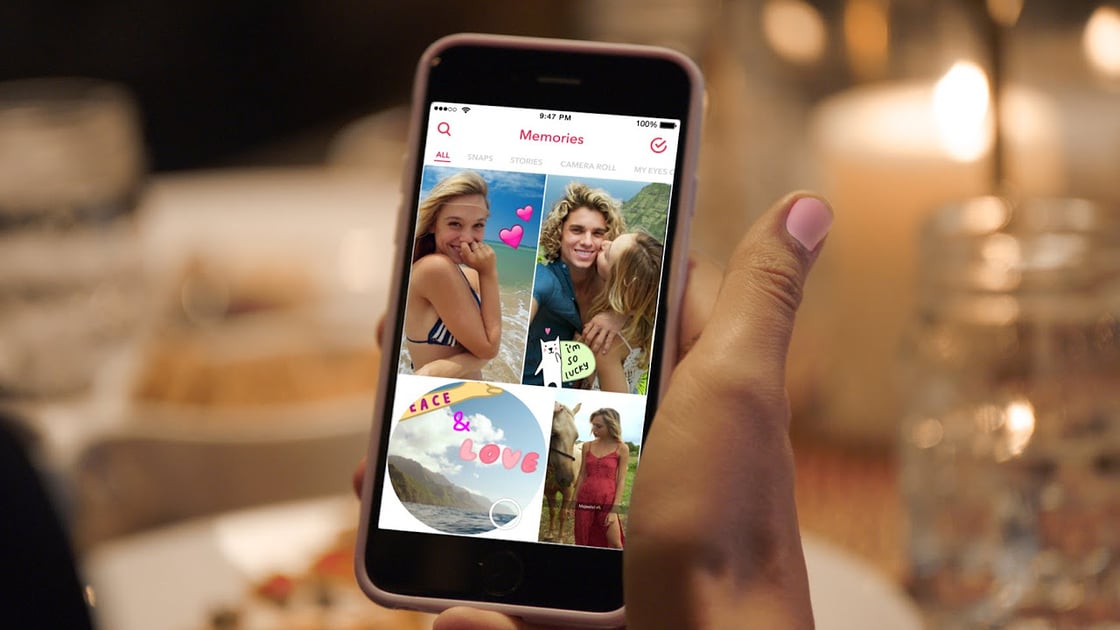

Snap stock soared 16% last week after just three Wall Street pros initiated coverage with bullish market calls. Bulls charge inIt's only natural for the market to place more weight on the bullish coverage initiated by Monness Crespi Hardt, Drexel, and OTR Global last week. If you had just handed over Snap stock at $17 to your top clients nearly four weeks ago, it's a safe bet that you would continue to be bullish with the stock in the low $20s. JMP Securities initiated coverage with an outperform call and a price target of $30. Not every underwriter jumped in with bullish coverage.

read more visit us Markets

Companies around the world are building out battery capacity to fill the needs of automakers and energy storage developers alike. At the same time, Tesla's success in EVs and the growth of energy storage haven't gone unnoticed by competitors. That trend could change, but companies are investing in new battery capacity for projected demand for EVs and energy storage. But since then, lots of competitors have begun expanding battery capacity. For now, a combination of slower-than-hoped-for growth in EV demand and a boom in battery supply will leave the market oversupplied with batteries for the foreseeable future.

as informed in

What Happened in the Stock Market Today -- The Motley Fool

Sealed Air (NYSE:SEE) and Cal-Maine Foods (NASDAQ:CALM) were a few of the individual stocks that attracted the greatest investor interest on Monday. Sealed Air still believes this is the right move for the company even if it will lower the company's sales base by almost 40%. Sealed Air plans to direct most of the $2.5 billion in net proceeds toward paying down debt that, as of the end of 2016, was $4 billion. Sealed Air's $3.2 billion dealSealed Air stock dropped 2.5% on heavy trading volume after the company announced a deal to raise cash by parting with a big chunk of its business. Today's stock marketIndex Percentage Change Point Change Dow (0.22%) (45.74) S&P 500 (0.10%) (2.39)Financial stocks trailed the broader market, which sent the popular Financial Select Sector SPDR ETF (NYSEMKT:XLF) down by 0.4%.

Snap stock soared 16% last week after just three Wall Street pros initiated coverage with bullish market calls. Bulls charge inIt's only natural for the market to place more weight on the bullish coverage initiated by Monness Crespi Hardt, Drexel, and OTR Global last week. If you had just handed over Snap stock at $17 to your top clients nearly four weeks ago, it's a safe bet that you would continue to be bullish with the stock in the low $20s. JMP Securities initiated coverage with an outperform call and a price target of $30. Not every underwriter jumped in with bullish coverage.

read more visit us Markets

Comments

Post a Comment