"Since November 8th, Election Day, the Stock Market has posted $3.2 trillion in GAINS and consumer confidence is at a 15 year high. Evidently, investors believe that Trump can keep the bull market going. That's not as high as it was during the late nineteen-nineties, but it exceeds the levels seen during any other bull market since the Second World War. Thursday marks eight years since the low point of the last bear market on Wall Street. (My colleague James Surowiecki wrote recently about the business world's view of Trump as a risky but not completely uncertain bet.)

referring to

"The ever so unloved and disdained bull market might have more upside than even its earliest adapters and supporters project," Stoltzfus said. If the bull market is worried about dying, it's not letting on. The bull market, driven by easy monetary policy from central banks and a doubling in corporate profits, shows few signs of waning as it heads into its ninth year. During the Internet boom, the only post-war bull market that lasted longer than this one, year nine saw such days surge to 95. In an average bull market, the number of days with 1 percent move usually more than doubles to 65 in year seven after falling in the first three years.

Investors also added cash to U.S.-based taxable-bond funds, a category including Treasuries and corporate debt, for the 13th straight week. Continue Reading BelowStock mutual funds and exchange-traded funds in the United States attracted $9.1 billion, while bond funds gathered $9.7 billion, the trade group's data showed. Investors pumped up their risk in the latest week, delivering U.S.-based stock funds their fifth straight week of net cash, Investment Company Institute data showed on Wednesday. Those funds took in $9.5 billion in the latest week. U.S.-based equity funds that invest domestically attracted $5.8 billion, while those invested abroad took in $3.4 billion in their 13th consecutive week of inflows.

read more visit us Markets

collected by :Jack Luxor

referring to

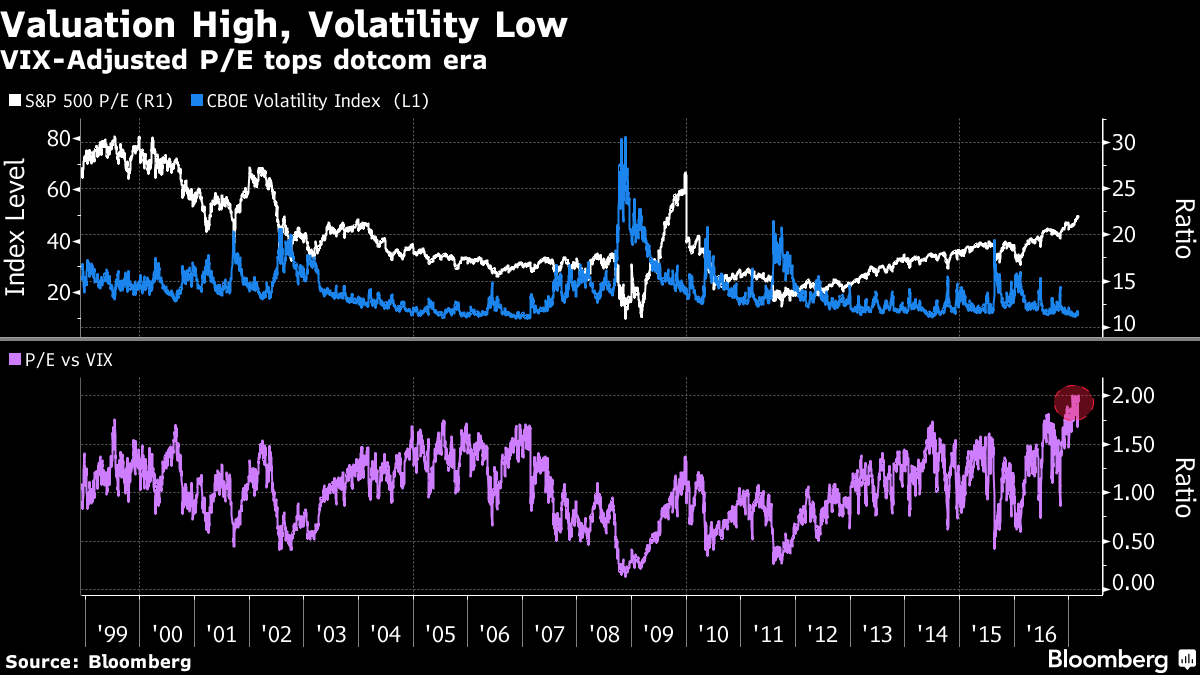

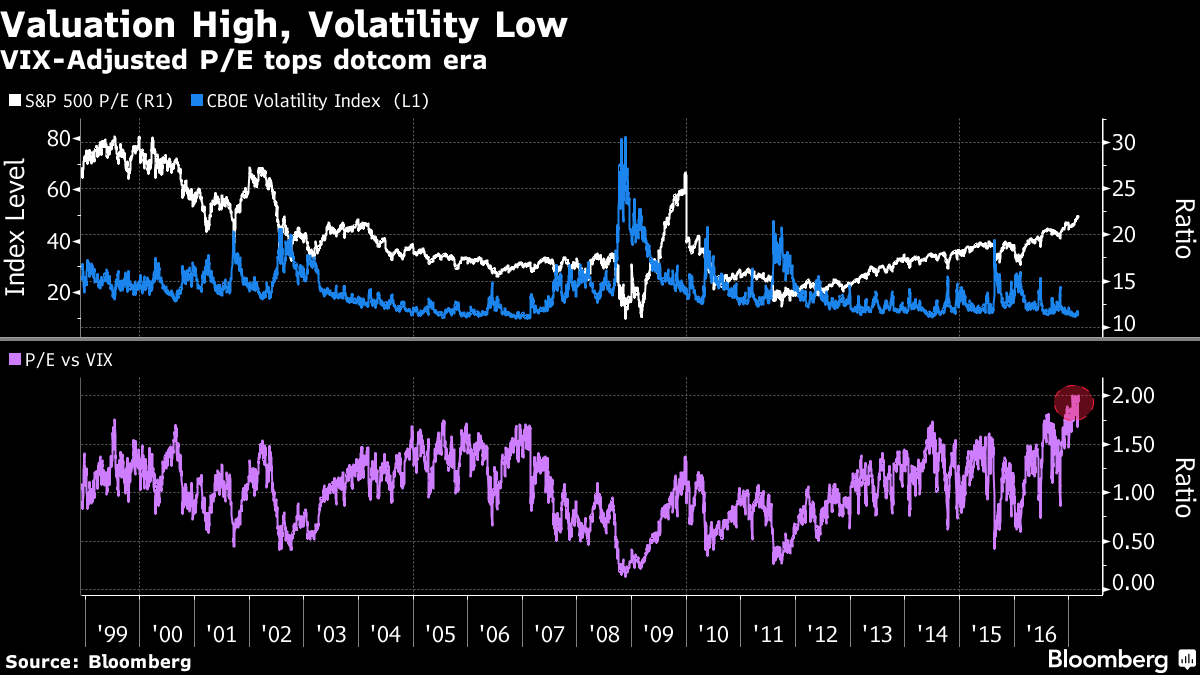

A Freakish Calm Surrounds the Eight-Year Bull Market

"The ever so unloved and disdained bull market might have more upside than even its earliest adapters and supporters project," Stoltzfus said. If the bull market is worried about dying, it's not letting on. The bull market, driven by easy monetary policy from central banks and a doubling in corporate profits, shows few signs of waning as it heads into its ninth year. During the Internet boom, the only post-war bull market that lasted longer than this one, year nine saw such days surge to 95. In an average bull market, the number of days with 1 percent move usually more than doubles to 65 in year seven after falling in the first three years.

Investors Storm Into U.S. Funds as Bull Market 'Ages and Rages'

Investors also added cash to U.S.-based taxable-bond funds, a category including Treasuries and corporate debt, for the 13th straight week. Continue Reading BelowStock mutual funds and exchange-traded funds in the United States attracted $9.1 billion, while bond funds gathered $9.7 billion, the trade group's data showed. Investors pumped up their risk in the latest week, delivering U.S.-based stock funds their fifth straight week of net cash, Investment Company Institute data showed on Wednesday. Those funds took in $9.5 billion in the latest week. U.S.-based equity funds that invest domestically attracted $5.8 billion, while those invested abroad took in $3.4 billion in their 13th consecutive week of inflows.

read more visit us Markets

collected by :Jack Luxor

Comments

Post a Comment